Taxes may be broadly categorized into national tax, collected by the central government to supply necessary resources for the provision of national defense and social services, and local tax which is collected by the local governments of the city (si),county (gun) and ward (gu) to supply necessary resources for local traffic and public welfare etc. Foreigners, as well as Koreans, are liable to pay taxes as a resident in the country.

National Tax

- Inquiries on National Tax - IRS website: www.nts.go.kr (available in English) ☎ 126

- Levied by the Tax Office, it is used as a country management resource and it constitutes income tax, corporate tax, inheritance tax and gift tax, education tax, comprehensive real estate holding tax and VAT etc.

Local Tax

- Inquiries on Local Tax - Incheon Metropolitan City Electronic Notice Payment System website : etax.incheon.go.kr ☎ 032-440-3061 or 3062

- Levied by the local governments of the city (si), province (do), county (gun) and ward (gu), it is used as a management resource for each local government and it includes acquisition tax, residence tax and vehicle tax etc.

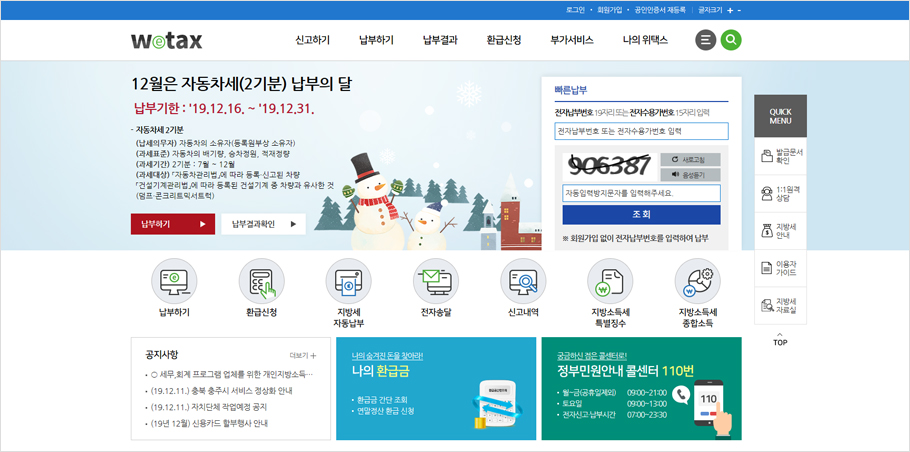

- Payment of local tax? "Wetax!“

- Various reporting services other than the verification and payment of local taxes are available acrossr the entire country through the wetax website (www.wetax.go.kr).

- Also, tax matters may be handled more easily by downloading the ‘Wetax Mobile App’ onto smartphones.